The main difference is that IRR is a discounted cash flow formula, while ARR is a non-discounted cash flow formula. One of the easiest ways to figure out profitability is by using the accounting rate of return. There are a number of formulas and metrics that companies can use to try and predict the average rate of return of a project or an asset. We are given annual revenue, which is $900,000, but we need to work out yearly expenses. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing.

Performance evaluation

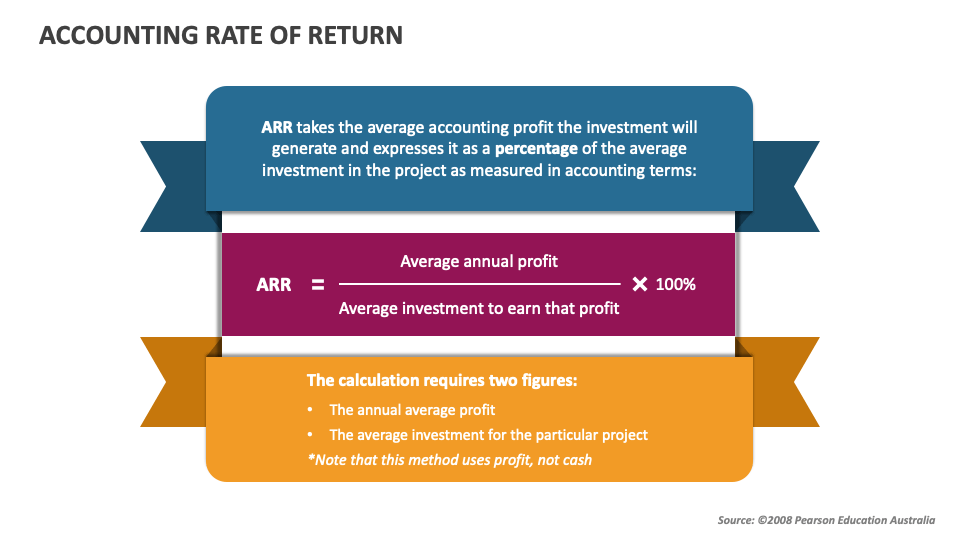

Another variation of ARR formula uses initial investment instead of average investment. The accounting rate of return (ARR) is a simple formula that allows investors and managers to determine the profitability of an asset or project. Because of its ease of use and determination of profitability, it is a handy tool to compare the profitability of various projects. However, the formula does not consider the cash flows of an investment or project or the overall timeline of return, which determines the entire value of an investment or project.

How to Calculate ARR?

The accounting rate of return is a capital budgeting metric to calculate an investment’s profitability. Businesses use ARR to compare multiple projects to determine each endeavor’s expected rate of return or to help decide on an investment or an acquisition. Since ARR is based solely on accounting profits, ignoring the time value of money, it may not accurately project a particular investment’s true profitability or actual economic value. In addition, ARR does not account for the cash flow timing, which is a critical component of gauging financial sustainability. An ARR of 10% for example means that the investment would generate an average of 10% annual accounting profit over the investment period based on the average investment. In today’s fast-paced corporate world, using technology to expedite financial procedures and make better decisions is critical.

Do you already work with a financial advisor?

Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications. Accounting Rate of Return is calculated by taking the beginning book value and ending book value and dividing it by the beginning book value. The Accounting Rate of Return is also sometimes referred to as the «Internal Rate of Return» (IRR). Calculating the rate of return gets the percentage change from the beginning of the period to the end. Remember that you may need to change these details depending on the specifics of your project. Overall, however, this is a simple and efficient method for anyone who wants to learn how to calculate Accounting Rate of Return in Excel.

What is Accounting Rate of Return (ARR)?

Recent FFM exam sittings have shown that candidates are struggling with the concept of the accounting rate of return and this article aims to help candidates with this topic. As the ARR exceeds the target return on investment, the project should be accepted. The initial cost of the project shall be $100 million comprising $60 million for capital expenditure and $40 million for working capital requirements. Average Annual Profit is the total annual profit of the projects divided by the project terms, it is allowed to deduct the depreciation expense.

Performance benchmark

Accounting Rate of Return formula is used in capital budgeting projects and can be used to filter out when there are multiple projects, and only one or a few can be selected. They are now looking for new investments in some new techniques to replace its current malfunctioning one. The new machine will cost them around $5,200,000, and by investing in this, it would increase their annual revenue or annual sales by $900,000. Specialized staff would be required whose estimated wages would be $300,000 annually. The estimated life of the machine is of 15 years, and it shall have a $500,000 salvage value.

Depreciation is a practical accounting practice that allows the cost of a fixed asset to be dispersed or expensed. This enables the business to make money off the asset right away, even in the asset’s first year of operation. The main difference between ARR and IRR is that IRR is a discounted cash flow formula while ARR is a non-discounted cash flow formula. ARR does not include the present value of future cash flows generated by a project. In this regard, ARR does not include the time value of money, where the value of a dollar is worth more today than tomorrow. In the above formula, the incremental net operating income is equal to incremental revenues to be generated by the asset less incremental operating expenses.

- It should therefore always be used alongside other metrics to get a more rounded and accurate picture.

- The company expects to increase the revenue of $ 3M per year from this equipment, it also increases the operating expense of around $ 500,000 per year (exclude depreciation).

- Company ABC is planning to purchase new production equipment which cost $ 10M.

- According to accounting rate of return method, the Fine Clothing Factory should purchases the machine because its estimated accounting rate of return is 17.14% which is greater than the management’s desired rate of return of 15%.

- The present value of money and cash flows, which are often crucial components of sustaining a firm, are not taken into account by ARR.

The company needs to decide whether or not to make a new investment such as purchasing an asset by comparing its cost and profit. Average accounting profit is the arithmetic mean of accounting what are the best invoice payment terms for your small business income expected to be earned during each year of the project’s life time. Average investment may be calculated as the sum of the beginning and ending book value of the project divided by 2.

In this blog, we delve into the intricacies of ARR using examples, understand the key components of the ARR formula, investigate its pros and cons, and highlight its importance in financial decision-making. AMC Company has been known for its well-known reputation of earning higher profits, but due to the recent recession, it has been hit, and the gains have started declining. A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation. Some limitations include the Accounting Rate of Returns not taking into account dividends or other sources of finance.

Company A is considering investing in a new project which costs $ 500,000 and they expect to make a profit of $ 100,000 per year for 5 years. HighRadius Autonomous Accounting Application consists of End-to-end Financial Close Automation, AI-powered Anomaly Detection and Account Reconciliation, and Connected Workspaces. Delivered as SaaS, our solutions seamlessly integrate bi-directionally with multiple systems including ERPs, HR, CRM, Payroll, and banks.

The incremental operating expenses also include depreciation of the asset. A company is considering in investing a project which requires an initial investment in a machine of $40,000. Net cash inflows of $15,000 will be generated for each of the first two years, $5,000 in each of years three and four and $35,000 in year five, after which time the machine will be sold for $5,000. Accounting Rate of Return, shortly referred to as ARR, is the percentage of average accounting profit earned from an investment in comparison with the average accounting value of investment over the period. Below is the estimated cost of the project, along with revenue and annual expenses. Depreciation is a direct cost that reduces the value of an asset or profit of a company.